Real Estate

For each parcel of land, the improvements, such as buildings, must be measured and described through on-site inspections by field appraisers. The state closely monitors counties for their accuracy in valuing property. Under current Kansas statutes, all real property is revalued annually. Sales data is closely monitored and analyzed by the appraisers to help determine fair and uniform values. The Appraiser's office DOES NOT set taxes, but instead determines only the fair market value of the property. The amount of taxes each taxpayer pays is determined by all the taxing agencies, i.e., city, county, school districts, etc. and depends on the amount of taxes needed to provide all the services the taxpayers require. The assessed value is determined by multiplying the fair market value of the property, as determined by the County Appraiser's office, by the assessment rate as outlined in the state constitution.

Homeowner Guide to Property Tax.pdf

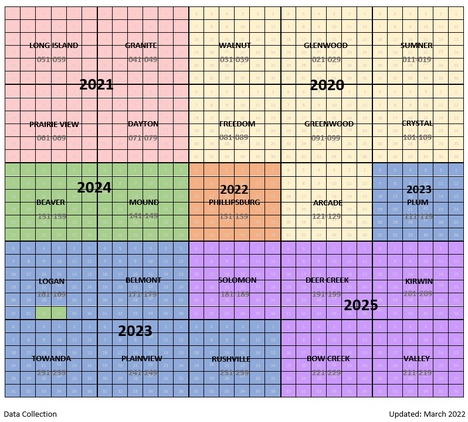

REAL ESTATE DATA COLLECTION

State statutes require that all properties be physically inspected and remeasured by an appraiser at least once in a six-year period. This helps ensure that all new construction and changes to existing improvements are discovered and added to the tax rolls. It also helps clean up the current data on the property should errors be found.

Interview the property owner - if no one is home a Data Collection form is left to be filled out and returned to our office

Inspect the property exterior for the condition of structures

Check to see if any improvements have been made: additions, deck, outbuildings

Check to see if any structures have been removed

Back in the office, the appraiser uses the data to analyze the property based on age, size, components and style of construction.

We appreciate all the information you're willing to share to keep our information on your property as accurate as possible.

In between the 6 year period it greatly helps if you let our office know if there have been any changes made by the property owner or distroyed|removed|damaged by the elements.

The appraiser's office receives permits from the city offices within the county to help keep up to date with new construction.

2022 our office will be data collecting Phillipsburg Township

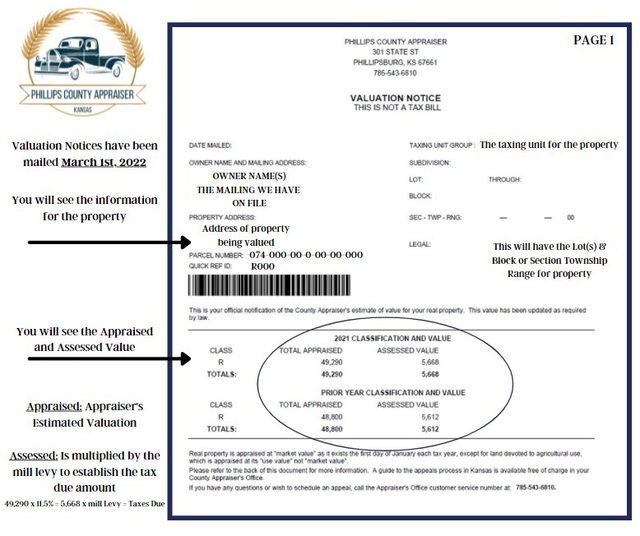

REAL ESTATE VALUATION NOTICES

The Appraiser mails notices of appraised values to the owners of each property on the first of March each year.

The valuation is determined by the property as it set January 1 of the current year.

The Annual Notice of Valuation form will provide current year's and previous year's history of your property's valuation.

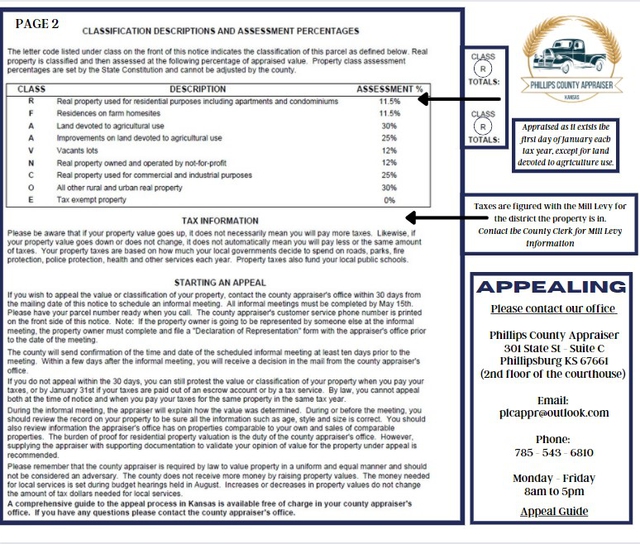

REAL ESTATE CALCULATING ASSESSED VALUES

To calculate assessed value, multiply the appraised value by one of the following state assessment rate:

| Property Tax | Assessment Rate |

| Agricultural Buildings | 25% |

| Agriculture Land* | 30% |

| Commercial / Industrial | 25% |

| Not-For-Profit | 12% |

| Public Utility | 33% |

| Residences on Farm Homesites | 11.5% |

| Residential | 11.5% |

| Vacant Lots | 12% |

| All other rural and urban property | 30% |

**By law agriculture land is not valued at fair market value, but value by productivity and use.

EXAMPLE: Fair Market Value of the Residential Home: $150,000

Assessment Rate: 11.5%

$150,000 x 11.5% = $17,250

Assessed Value: $17,250 Mill Levy: 120 Mills or 0.120 $17,250 x 0.120 = $2,070 Amount of Taxes